Medicaid Application And Elder Law Attorney

Who Needs, And Who Can Get, A Medicaid Plan?

Medicaid is mostly funded and regulated by the state where you live, administered by your county and is used for paying medical bills and to fund nursing care, nursing home care, assisted living care and other forms of long term care.

Unlike Medicare, which is a federal program and designated primarily based on reaching the age of 65, work status and certain medical and disability conditions, Medicaid is resource based and is therefore available for young and old, provided that rigorous qualifications are met. Some of these qualifications include a limit on how much money you can earn, the value of assets you own, and how much assets you have given away in the past five years (known as the five year “look-back” rule). These rules, particularly those relating to the definition and type of assets that can be owned can be very complex

There are many different types of Medicaid programs available. Kaplan Law Practice, LLC focuses on institutional Medicaid available for the elderly and disabled. While you do not need a lawyer to apply for Medicaid, having a Medicaid application and elder law attorney working on your side may improve the outcome of your application. Our attorney has experience in Medicaid applications in general and especially the area of Medicaid for the elderly and disabled. We generally charge flat non-hourly fees for services in the area of Medicaid application consultation and Medicaid planning

Why Are Medicaid Applications Rejected?

One of the most common reasons that people have their Medicaid application rejected, (or that they do not think to apply at all) is that they fail to meet Medicaid’s strict requirement for maximum earnings, or they own too many assets. A primary way to legally avoid Medicaid application being rejected because of your assets is known as Medicaid Planning. Medicaid planning is done by structuring your assets in a way that allows you to avoid the maximum asset size of Medicaid. However, lack of careful planning can result in a Medicaid application being rejected. This is why you should have a competent attorney advise you

Medicaid Planning – Why Do It?

Medicaid planning focuses on ensuring that asset ownership will not prevent you from qualifying for benefits should those become needed.

If you are still relatively young and in good health, it is wise to explore Medicaid planning before it becomes more difficult as you age. One reason why early planning is helpful is because nearly every state (Except California) has a “look back” rule. If you gave away significant assets within the last five years you will generally not be eligible for Medicaid. Making careful legal plans earlier will thus allow you to apply for Medicaid at a younger age. If you are responsible for a disabled adult or child, the prohibitive cost of out-of-pocket medical payments or private insurance plans may mean Medicaid benefits may be your only choice.

How Can Our Firm Help With Medicaid Planning?

Here is what we can do if you do not yet need Medicaid, but may need to apply for Medicaid in the future

- Asset Analysis

Analysis to determine your chances of qualifying for Medicaid. Analyzing your assets will allow for assessing whether that asset will put you over the limit of your state’s asset limit – and if it is the type of asset that violates the Medicaid rule. Not all assets are problematic, such as the home the applicant lives which can be exempt from Medicaid application asset limits, and possibly a vehicle as well

- Estate Plan Review

We can determine if your existing estate plan will hurt or help in applying for Medicaid, someone may have advised you to create a plan to avoid Medicaid penalties. You should consult a competent lawyer to ensure that the plan you created will work – and that it does not violate any state Medicaid laws

- Recommend And Create Trust And Other Planning Structures

W can make recommendations to legally reduce the value of assets you are holding. Kaplan Law Practice will guide you through the process of choosing the right type of trust or estate plan that is tailor made for your needs

- Planning For Providing For The Well-being Of A Disabled Individual

We can plan for future needs through forming Special and Supplemental Needs Trust (SNT) arrangements (to accommodate contributions that are outside ABLE Act provisions). Almost all states have created special bank accounts, called ABLE accounts with the purpose of alleviating some of the financial stress that caretakers of a disabled individual can go through. An ABLE account can be tax deductible. It can also shield assets contained within from counting towards the Medicaid asset threshold. However, there can be limits on these accounts, such as how much money can be deposited into them. Kaplan Law Practice, LLC will assist in creating a Special Needs Trust (SNT) that circumvents these issues and that can hold significant assets and funds to help provide for a person with special needs without being counted towards the limit on asset ownership

Already Know You Need Medicaid?

Kaplan Law Practice, LLC can Assist with the Following:

- Consultation On Medicaid Eligibility

See the above paragraph titled “Asset Analysis” and “Estate Plan Review” for a more detailed explanation of a Medicaid consultation

- Assistance With Document Assembly Required For A Medicaid Application

The Medicaid checklist may seem daunting, but our elder law firm will help you confidently navigate the application process

- Pre-application Permitted Asset Transfers

If you decide to create a trust or any other estate planning device to legally reduce your assets and become Medicaid eligible, we will create the trust and other documents for you

- We Will Apply For Medicaid On Your Behalf

We will provide full prosecution support upon application in all New Jersey counties

Disclaimer: Opinions and Assessments provided by Kaplan Law Practice, LLC may be used for informational purposes only. Only the appropriate Division of Human Services, and the court of appropriate jurisdiction may make a determination of eligibility. We do not guarantee a successful outcome of any application

Medicaid Application Elder Law Statistics

Medicaid application and elder law services play a vital role in helping seniors access healthcare benefits and protect their assets as they age. According to the Kaiser Family Foundation (KFF), nearly 65 million Americans are enrolled in Medicaid, with a significant portion of the beneficiaries being elderly individuals who need long-term care. As the aging population grows, more seniors are turning to Medicaid for assistance with medical costs, particularly for long-term care, which can be financially devastating without insurance.

Elder law professionals are instrumental in navigating the complex Medicaid application process. According to the National Academy of Elder Law Attorneys (NAELA), approximately 60% of seniors who apply for Medicaid assistance do so with the help of an elder law attorney to ensure their eligibility and protect their assets. Medicaid planning, which often includes strategies such as asset protection and trusts, is crucial for families to avoid spending down all their savings on healthcare.

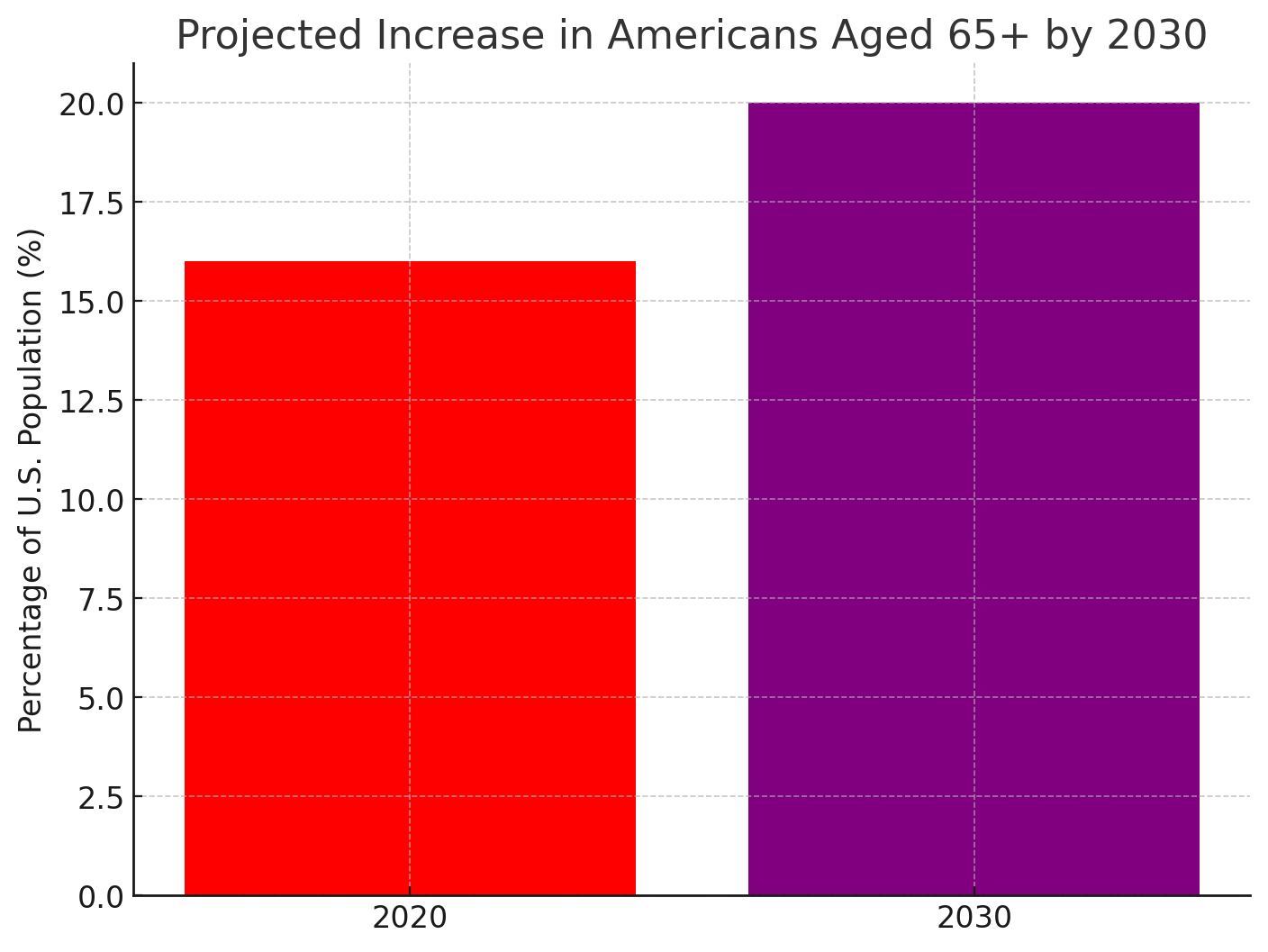

Furthermore, the demand for Medicaid planning and elder law services is expected to rise as the baby boomer generation reaches retirement age. By 2030, it is estimated that 1 in 5 Americans will be over the age of 65, significantly increasing the need for Medicaid assistance and elder law expertise.

Common Questions About Medicaid Eligibility Requirements For Elderly Individuals

Applying for Medicaid can be a complicated process, especially when it comes to understanding eligibility rules for elderly individuals. Many seniors and their families have concerns about income limits, asset restrictions, and the impact of homeownership on eligibility. By addressing some of the most common questions, we can provide clarity on how Medicaid works for those needing long-term care. If assistance is needed, a Medicaid application elder law lawyer can help understand the process and ensure proper planning.

What Are The Basic Medicaid Eligibility Requirements For Elderly Individuals?

Medicaid eligibility for seniors depends on several factors, including age, income, and assets. Generally, applicants must be 65 or older, have limited income, and meet asset restrictions set by their state’s Medicaid program. Each state has different financial limits, and certain assets may be exempt from consideration. In addition to financial criteria, seniors must also demonstrate a medical need for long-term care if they are applying for Medicaid-funded nursing home services.

How Does Income Impact Medicaid Eligibility For Seniors?

Medicaid sets income limits that vary by state, and seniors must meet these thresholds to qualify. Income includes sources like Social Security, pensions, and retirement account distributions. In some cases, seniors with income slightly above the limit may still qualify through a spend-down program, which allows them to apply excess income toward medical expenses until they reach the eligibility threshold. For those applying for long-term care coverage, certain states allow the use of a Miller Trust, or Qualified Income Trust, to redirect income and meet eligibility requirements.

What Assets Are Considered When Determining Medicaid Eligibility?

Medicaid has strict asset limits, and only certain types of property count toward eligibility. Cash, bank accounts, investments, and additional real estate are considered countable assets, while a primary residence, personal belongings, and prepaid burial plans may be exempt. The limits vary by state, and those with assets above the threshold may need to spend down excess resources on medical care or consider legal strategies with assistance from our Medicaid planning attorney that allow them to preserve assets while still qualifying. A Medicaid application elder law lawyer can provide guidance on structuring finances to meet eligibility rules.

Can A Senior Still Qualify For Medicaid If They Own A Home?

Yes, a senior can still qualify for Medicaid while owning a home, as long as it is their primary residence and its value falls below the state’s equity limit. In many cases, Medicaid does not count a primary home as an asset as long as the applicant or their spouse continues to live there. However, after the senior’s passing, Medicaid may attempt to recover costs through estate recovery, which could impact heirs. Proper planning can help protect a home while allowing an individual to receive needed care.

What Is The Medicaid Lookback Period And How Does It Affect Eligibility?

The Medicaid lookback period is a rule that prevents individuals from giving away assets to qualify for benefits. When someone applies for Medicaid, the state reviews their financial transactions for the past five years. If assets were transferred for less than fair market value, Medicaid may impose a penalty period, delaying eligibility. The length of the penalty depends on the value of the transferred assets and the cost of care in the applicant’s state. Planning ahead with help from our medicaid estate planning lawyer can help avoid these penalties and protect financial stability.

Preparing For Medicaid And Long-Term Care Needs

Our elder law medicaid attorney will share that understanding Medicaid eligibility is important for seniors and their families. The rules can be difficult to manage, especially when assets and income come into play. By taking proactive steps and seeking legal guidance with a lawyer licensed in New York and New Jersey, seniors can find solutions that allow them to qualify for benefits without sacrificing financial security. If assistance is needed, a Medicaid application elder law lawyer can provide advice on planning strategies that work within the law, our team offers down to earth legal support. For personalized support, Kaplan Law Practice, LLC is available to discuss options and answer questions.

Contact Our Firm Today

At Kaplan Law Practice, LLC, we understand that Medicaid planning and elder law issues often arise unexpectedly and require swift, informed action. Our team is here to guide you through the legal layers of asset protection, long-term care planning, and urgent Medicaid applications with clarity and compassion. Don’t wait until it’s too late—contact our Medicaid application and elder law attorney today to schedule a consultation and get the trusted support you need.