Estate Planning And Asset Protection Practice

Do you need to have a Will completed on short notice, or even the next day? Now offering Urgent Will Service. Call 201-773-0776 to check for availability in your area.

You have worked hard to build your next egg. You should work even harder to safeguard it and ensure that it benefits your progeny in the future. Our estate planning and asset protection lawyer is here to help.

While Estate Planning and Asset Protection are separate fields, the tools used in each field overlap. For this reason, when setting up your estate plan, it is a good idea to consider whether asset protection is right for your family. The most basic distinction between estate planning and asset protection is that the former looks to preserve and distribute your assets among your family or charities, while the latter is concerned with preserving your assets against future lawsuits and creditors during your lifetime.

We are a premier law firm located in Northern New Jersey. When you work with our attorney, your long term goals will be translated into a comprehensive asset protection or estate plan. Do not forget that poor asset planning can have significant tax impact. Only a lawyer with experience and knowledge of federal and state statutes is able to draft a will or a trust that works for you. Kaplan Law Practice is there to serve you in New York City as well. Our midtown offices are conveniently located within walking distance from Penn Station, Subway, Path and the Port Authority Bus Terminal.

Traditionally, the terms “Estate” or “Asset Protection,” have been associated with wealth, power, fame or influence. In reality, these terms apply to everyone. Today more then ever before it is critical to establish a plan that works for you and for your assets. The professionals at Kaplan Law Practice rely on their expertise and experience in setting up affordable Estate solutions for working New York and New Jersey families just like yours.

Because of the personal nature of this subject, it is essential that you and your attorney are able to forge a strong relationship based on trust. Smooth, honest and prompt communication is critical to maintaining such relationship. Since we are a small firm, we understand the importance of every individual and priorities of every family. Our vision is not clouded by tiers of seniority and billing structure. All clients at Kaplan Law Practice, receive the same diligent and personal treatment, irrespective of the size of their estate.

If you follow financial and political headlines, it would seem to you that every year the Federal Government finds it necessary to tweak laws that govern how estates are taxed or distributed, or how assets appear on your tax return. In this uncertain climate, it is essential that all individuals, families and small businesses establish Asset or Business Continuity plans that are inline with their wishes and which make financial sense. Doing it yourself using cheap software packages or just leaving it up to chance, is simply irresponsible. Please make the right choice today and safeguard your assets by contacting Kaplan Law Practice. Flat fees and payment plans can be arranged in most situations.

Drafting All Types Wills

- Since no two family situations are alike, each Will needs to be created nearly from scratch for every single client. We draft Wills that take into account client’s wishes, potential changes in the relevant law and tax consequences.

- Are you looking for a Kosher Will? Ask Joshua Kaplan Esq. for details. Not sure what it is? This is a carefully worded addendum to the common will, which ensures that the provisions of the will do not contradict Biblical law.

Drafting Trusts And Asset Preservation Planning

Attorneys at Kaplan Law Practice are skilled in selecting an Asset plan that is right for you. In many cases, this means identifying and drafting a trust or several trusts that achieve your asset protection/estate distribution goals. Asset protection planning, especially if it involves trusts, is not for everyone. However, there are circumstances when even smaller estates require extensive planning. Please contact the attorneys at Kaplan Law Practice, LLC., to set up an appointment to review your individual situation. Please ask us how to protect your assets and make sure that they grow in value. Our practice works closely with reputable and knowledgeable investment consultants. We will ensure that the entire process is 100% transparent to you.

Medicaid Planning Through Trusts And Asset Distribution

- Did you know that Medicare does not cover healthcare expenses associated with long term care and home care? If you are getting older and are concerned about health benefits for old age, you are not alone. Most middle-class Americans will be faced with the hard decision of having to spend down their assets in order to pay for health care. Kaplan Law Practice is here to tell you that you do not need to be one of them if you act now. Deficit Reduction Act and other legislation have reduced the spectrum of available options, but your chances of preserving your property for your children is much greater if you act while still relatively young and healthy. Do not delay, call Kaplan Law Practice now for a comprehensive Medicaid planning advice for NY and NJ.

Creation Of Living Wills And Healthcare Proxies Powers Of Attorney

- Do not assume that loving, long term relationship, or even a marital relationship, entitles one individual to represent the wishes of another in court, government office, at the hospital or at a financial institution. You will be required to have a formal power of attorney document that is properly executed, in accordance with the law. Please be aware that today’s hospitals operate like efficient conveyer belts. Therefore, it is especially important to clearly communicate your healthcare wishes to a person you trust.

Tax Planning

- Every Estate/Asset preservation planning involves careful, thorough analysis of relevant tax consequences. While success or satisfaction of such analysis is limited by client disclosure, uncertainty of potential legislation, or court decisions, it is important to consult a professional, such as Joshua Kaplan. Esq., of Kaplan Law Practice regarding tax implications of your long-term asset goals.

Creditor And Litigation Protection Planning

- This is an essential part of every Estate or Asset plan. When considering this type of a plan, it may be a good idea to develop a comprehensive plan. Participation of understanding and skilled practitioner is essential. Call Kaplan Law Practice now before you take out a loan, apply for government benefits or become a party to a lawsuit.

Business Continuity Planning

- A continuity plan for a business is a commonly overlooked component of estate planning. While there are default statutes that try to assist administration of estates for those who failed to plan, there is almost nothing available to assist businesses that have lost a critical decision maker, expert, or a source of funding, and do not have a plan in place which identifies a replacement. Lack of a proper plan will cause a thriving, successful business to quickly disintegrate and fail. If your business does not have a business continuity plan, you are potentially inviting financial disaster for yourself and your employees.

Estate Planning And Asset Protection Statistics

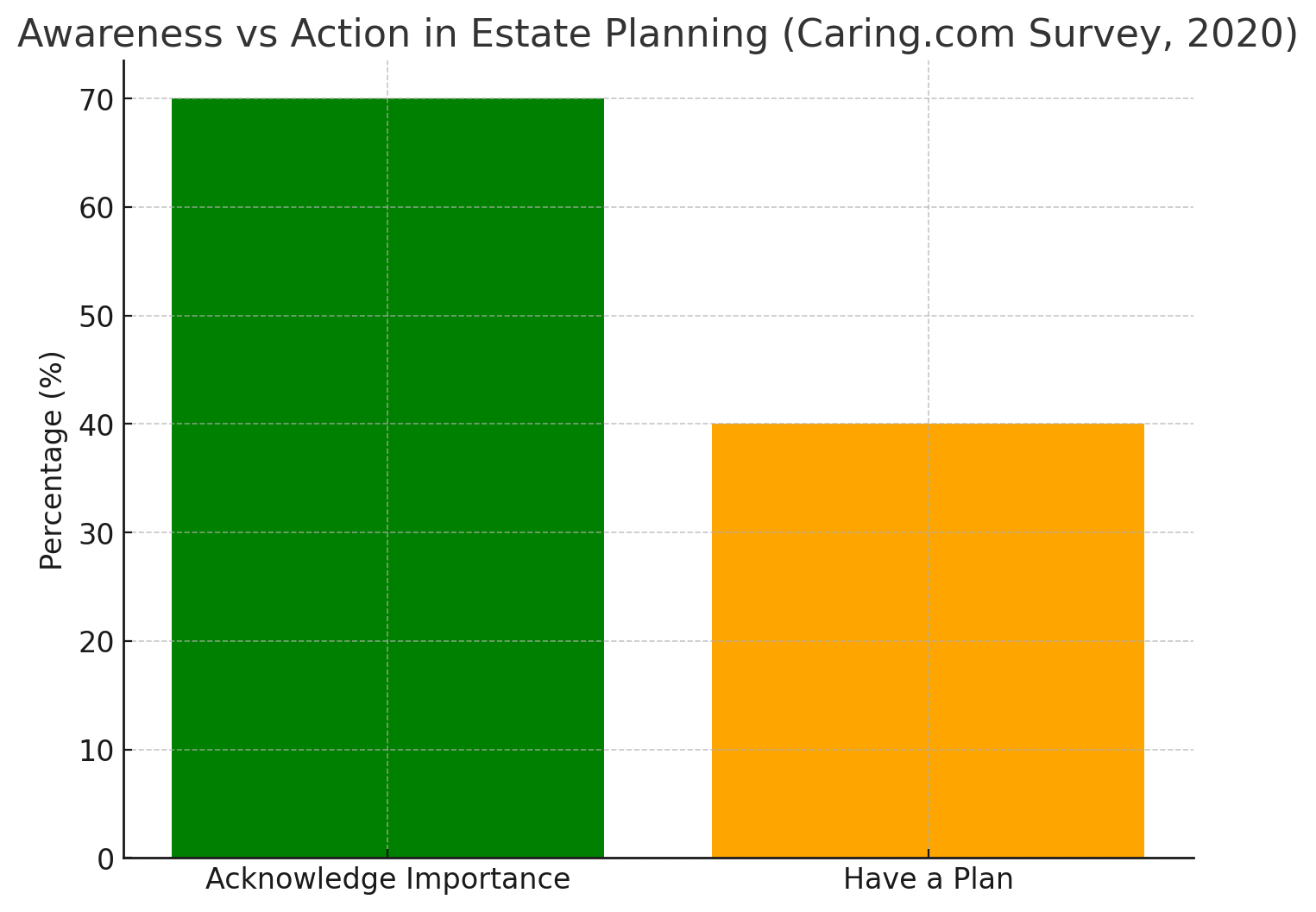

Estate planning and asset protection are critical components of financial planning, ensuring that individuals’ assets are distributed according to their wishes and protected from potential risks. According to a 2020 survey by Caring.com, 60% of Americans do not have a will or estate plan in place, despite the fact that nearly 70% of adults acknowledge the importance of having one (Caring.com, 2020). This statistic highlights the significant gap between awareness and action in estate planning, often due to misconceptions about the complexity or cost of the process.

In terms of asset protection, many people are also unaware of the importance of safeguarding their wealth from creditors, lawsuits, or other risks. The American Bar Association (ABA) reports that asset protection planning is an essential part of estate planning, particularly for high-net-worth individuals, business owners, and professionals. However, research shows that fewer than 10% of small business owners implement formal asset protection strategies, leaving many vulnerable to unexpected financial challenges.

Overall, estate planning and asset protection are areas where greater education and proactive engagement are needed. As more people plan for their future, the focus on protecting wealth and ensuring smooth wealth transfer continues to grow.

Common Questions About Estate Planning And Asset Protection

To protect our assets and provide for loved ones, it’s important to plan for the future by taking key steps in estate planning. Whether we are drafting a will, setting up a trust, or securing business assets, it is important to have a plan that reflects our goals. Estate planning and asset protection involve legal strategies that require help from our estate planning attorney who can help manage wealth, minimize risks, and avoid unnecessary complications. Working with an estate planning and asset protection lawyer can help us make informed decisions and avoid costly mistakes.

How Often Should I Update My Estate Plan?

An estate plan should be reviewed regularly to reflect any changes in our financial situation, family structure, or legal requirements. Major life events such as marriage, divorce, the birth of a child, or acquiring significant assets may require adjustments. Laws governing estate planning can also change, making it important to update documents as needed. Reviewing an estate plan every three to five years, or sooner if a major change occurs, helps keep everything in line with our current needs and goals.

Can Estate Planning Protect My Business Assets?

Yes, business owners can use estate planning strategies to protect assets from potential risks. Setting up a trust, forming a limited liability company (LLC), or structuring ownership in a way that separates personal and business assets can help reduce exposure to liability. Business succession planning is also an important part of protecting assets, as it outlines who will take over the business in the event of retirement, incapacity, or passing. These steps help provide stability and prevent unnecessary disruptions. Consulting with our estate planning lawyer can help determine the best approach for business owners.

What Is A Power Of Attorney And Why Do I Need One?

A power of attorney is a legal document that allows us to appoint someone to make financial or medical decisions on our behalf if we become unable to do so. Without a power of attorney, a court may have to appoint a guardian or conservator, which can delay important decisions. A financial power of attorney grants authority over financial matters, such as paying bills or managing investments, while a healthcare power of attorney allows someone to make medical decisions based on our wishes. Having these documents in place provides clarity and avoids unnecessary complications.

How Does Long-term Care Planning Fit Into Estate Planning?

Long-term care planning is an important part of estate planning, as medical costs and assisted living expenses can quickly deplete assets. Planning ahead allows us to explore options such as long-term care insurance, Medicaid eligibility, and asset protection strategies that help preserve wealth while covering necessary care. Creating a plan early can help prevent financial strain and provide peace of mind knowing that resources will be available when needed. Proper planning can also protect assets for heirs while addressing future healthcare needs.

What Are Common Mistakes People Make In Estate Planning?

Our asset protection attorney can share that one of the most common mistakes is failing to create an estate plan altogether, leaving loved ones to deal with unnecessary legal challenges. Another mistake is not updating documents to reflect major life changes, such as marriage, divorce, or the birth of children. Some people also overlook beneficiary designations on accounts like retirement funds and life insurance policies, which can cause unintended distributions. Relying solely on a will without considering trusts, tax planning, or asset protection strategies can also lead to complications. Working with an estate law attorney helps avoid these issues and keeps an estate plan aligned with current needs.

Keep Your Estate Plan Up To Date

Estate planning is an ongoing process that requires regular attention. Whether we are protecting personal assets, business interests, or planning for healthcare needs, having the right documents in place helps prevent unnecessary complications. Our estate planning and asset protection lawyer serving New York and New Jersey can provide guidance tailored to our unique circumstances. Contacting Kaplan Law Practice, LLC can help us take the right steps to safeguard our future and the financial well-being of our loved ones.