Estate Planning Lawyer Bergen County, NJ

Our Bergen County, NJ estate planning lawyer understands that life is a journey marked by milestones, achievements, and meaningful connections. As you navigate this journey, it’s essential to safeguard your assets, ensure the well-being of your loved ones, and leave a lasting legacy. Our dedicated legal team specializes in providing tailored estate planning services that empower you to secure your future and the futures of those you care about. Contact our team at Kaplan Law Practice, LLC today to discuss your case.

Table of Contents

- Understanding Estate Planning

- Differences Between Wills and Trusts

- 5 Reasons an Estate Plan Is Important

- Bergen County Estate Planning Infographic

- Bergen County Estate Planning Statistics

- Bergen County Estate Planning FAQs

- Kaplan Law Practice, LLC, Bergen County Estate Planning Lawyer

- Contact Our Bergen County Estate Planning Lawyer Today

Understanding Estate Planning

Estate planning is a personalized and forward-thinking process that involves creating a comprehensive strategy for managing your assets, healthcare decisions, and the distribution of your estate upon your passing. This meticulous planning allows you to control how your wealth is preserved, managed, and distributed, and it also helps minimize the potential impact of taxes and legal complications.

At Kaplan Law Practice, LLC, we recognize that no two individuals or families are alike. Our approach begins with listening to your unique needs, goals, and concerns. Our seasoned attorneys collaborate closely with you to understand your financial situation, family dynamics, and aspirations. With this foundation of understanding, we craft a customized estate plan that aligns with your wishes and ensures your legacy is preserved according to your exact specifications.

Components of Estate Planning:

- Will Creation: A will is the cornerstone of any estate plan. It outlines how your assets should be distributed, names guardians for minor children, and designates an executor to manage the process.

- Trusts: Trusts offer versatile tools to protect your assets, minimize taxes, and provide for loved ones. Our attorneys are well-versed in various trust types, including revocable living trusts, irrevocable trusts, and special needs trusts.

- Advance Healthcare Directives: These documents, including a living will and healthcare power of attorney, ensure your medical preferences are respected and that a trusted individual can make healthcare decisions on your behalf if you’re unable to do so.

- Financial Power of Attorney: Designating a financial power of attorney grants someone you trust the authority to manage your financial affairs should you become incapacitated.

- Estate Tax Planning: We employ strategic techniques to minimize estate taxes, helping you preserve more of your assets for your loved ones.

- Business Succession Planning: If you’re a business owner, we assist in developing a plan for the seamless transition of your business to the next generation or a chosen successor.

- Charitable Giving: For clients who wish to leave a philanthropic legacy, we offer guidance on establishing charitable trusts and foundations.

If you haven’t yet created a virtual estate plan, please connect with an experienced estate planning lawyer Bergen County, NJ residents trust. In today’s world, having a virtual estate plan in place is critically important. Some people may not think of establishing a virtual estate plan, and instead, opt for a traditional one on paper. Many people can benefit from having one. The only New Jersey residents who don’t need a virtual estate plan in place are most of those who are younger than 18 years of age and those who for whatever reason have chosen to remain electronically disconnected from the remainder of the world. A virtual estate plan offers many benefits, especially today where fraud and identity theft are common. If you are an adult and have so much as an email account and/or a social media log in, you’ll want to speak with a knowledgeable Bergen County, NJ estate planning lawyer about creating a legally enforceable virtual estate plan.

Differences Between Wills and Trusts

Most people are familiar with the terms “will” and “trust,” but are you aware of the differences between the two? Despite what some people believe, wills and trusts are not the same things, nor are they interchangeable. In some cases, it is advisable to have trust in addition to a will. If you have questions about the right estate planning tools for your particular situation, it is important to speak with a Bergen County, NJ estate planning lawyer who can give you the proper legal advice.

A Will Takes Effect After Death, and a Trust Starts Immediately

One of the main differences between a will and a trust is that a will does not become effective until after you are dead, whereas a trust is effective as soon as it is created and funded. A trust can also provide for the care of your assets in the event you are incapacitated. A will cannot do that — its purpose is to decide where your belongings and assets go after you are deceased.

A Will Is a Public Document

As a Bergen County, NJ estate planning lawyer can explain, a will becomes part of the court record when a probate case is opened. It is a public document, and anyone who requests copies of the probate case could, in theory, see everything written in the will. This means that anyone can see your assets with a detailed description, as well as who the beneficiaries are, and anyone can look at what you own and what your final wishes were. A trust is a private document that does not go through the same court process, so it remains confidential. This means no one has access to see what you own, who is the recipient, etc.

Trusts Allow You to Control the Distribution of Your Estate

With a trust, you have better control over the division of assets. Imagine you have a 19-year-old child who is slated to get $100,000 through your will. That means they will get it in one lump sum. With a trust, you can say that your child will get $10,000 per year until they reach a certain age, after which they can receive the full amount if they so desire. This allows you to safeguard your investments while making sure your loved ones receive something and are protected. A Bergen County, NJ estate planning lawyer can incorporate whatever stipulations you wish to have in any trust you set up for your beneficiaries.

Wills Go Through Probate

Wills must go through the probate process to verify they are valid. First, creditors are paid, and then assets can be divided as noted in the will. However, this process can take a significant amount of time — up to a year in some cases — and cost several thousand dollars. With a trust, assets are in the trust’s name and are not subject to probate.

5 Reasons an Estate Plan Is Important

An estate plan goes further than a will. It can be composed of multiple documents, and it is much more comprehensive. What you choose to include in an estate plan depends on your unique needs. Your will is an important element of your estate plan as it outlines your wishes regarding your assets after your death. But an estate plan also dictates your wishes about your health and finances while you’re living. An estate plan can include a living will, a healthcare power of attorney and a financial power of attorney, which are valid only until your death. Preparing an estate plan while you are healthy and of sound mind is recommended, especially if you have family members who may be affected. If you’ve been putting off your estate plan, here are five good reasons to make an appointment with an estate planning attorney to get started.

- Avoiding Probate

Probate is the legal process of distributing your estate to your beneficiaries. The probate process can be long, and there may be legal hurdles that could affect when it can be completed. Another reason many people want to avoid probate is that it prevents heirs from accessing their inheritance right away. If you want to avoid probate, you’ll need to work with an estate planning attorney to deal with your assets before your death. A will doesn’t negate probate. A trust can. Your estate planning and probate lawyer can help you navigate this process so you can avoid any issues that may come up during probate.

- Reducing and Even Eliminating Estate Taxes

Depending on the size of your estate, your beneficiaries may have inheritance taxes. You will want to make sure your taxes are handled properly before your assets are passed down to your beneficiaries. If you do not do so, they may have to go through the inconvenience of figuring it out themselves. There are some techniques that can be used to reduce the burden on your heirs, but again, you must set these things in place before your death. To learn what strategies you can use to minimize your inheritance taxes, talk to an estate planning lawyer to assist you in structuring your estate plan.

- Avoiding a Mess

Modern families are often complex, with multiple layers. One parent may have adult children from one spouse and minor children from another. You may own a business with an unrelated partner. Estate planning avoids family fights and costly court battles over who gets what and how. When your family involves unique custody arrangements, this is especially important to settle very early on. For example, if you and your ex-spouse want to designate guardians for your children, you will have to come to an agreement. Another area that you need to consider is how you want your future healthcare decisions to be carried out and by whom. You choose who is in charge of your assets if you are incapacitated, not just when you die. Because there are so many scenarios and topics within an estate plan that must be considered, you should have a thorough discussion with your family and loved ones about your specific goals and how you want them accomplished.

- Protecting Your Assets

Estate planning protects your assets during your lifetime. You could choose from a variety of legal strategies to secure your assets and keep them away from the wrong hands. If you are in a professional career where you could be sued, your estate plan can keep your assets from being seized. Asset protection planning is a legal and upfront way to protect your assets, but it must be done before any lawsuit is filed. The last thing you will want to do is think of a plan to put in place at the last minute once an issue has come up. To learn about ways you can protect your assets, reach out to an estate planning lawyer and they will be able to give you suggestions.

- Protecting Your Beneficiaries

With estate planning, you can name the trustee for your estate plan, keeping it out of the hands of someone who is bad at managing money. If you have minor children, you can be assured of who is handling their needs and finances until they become adults. Your estate plan can also protect you in the event of a divorce, depending on how it’s set up.

Bergen County Estate Planning Infographic

Bergen County Estate Planning Statistics

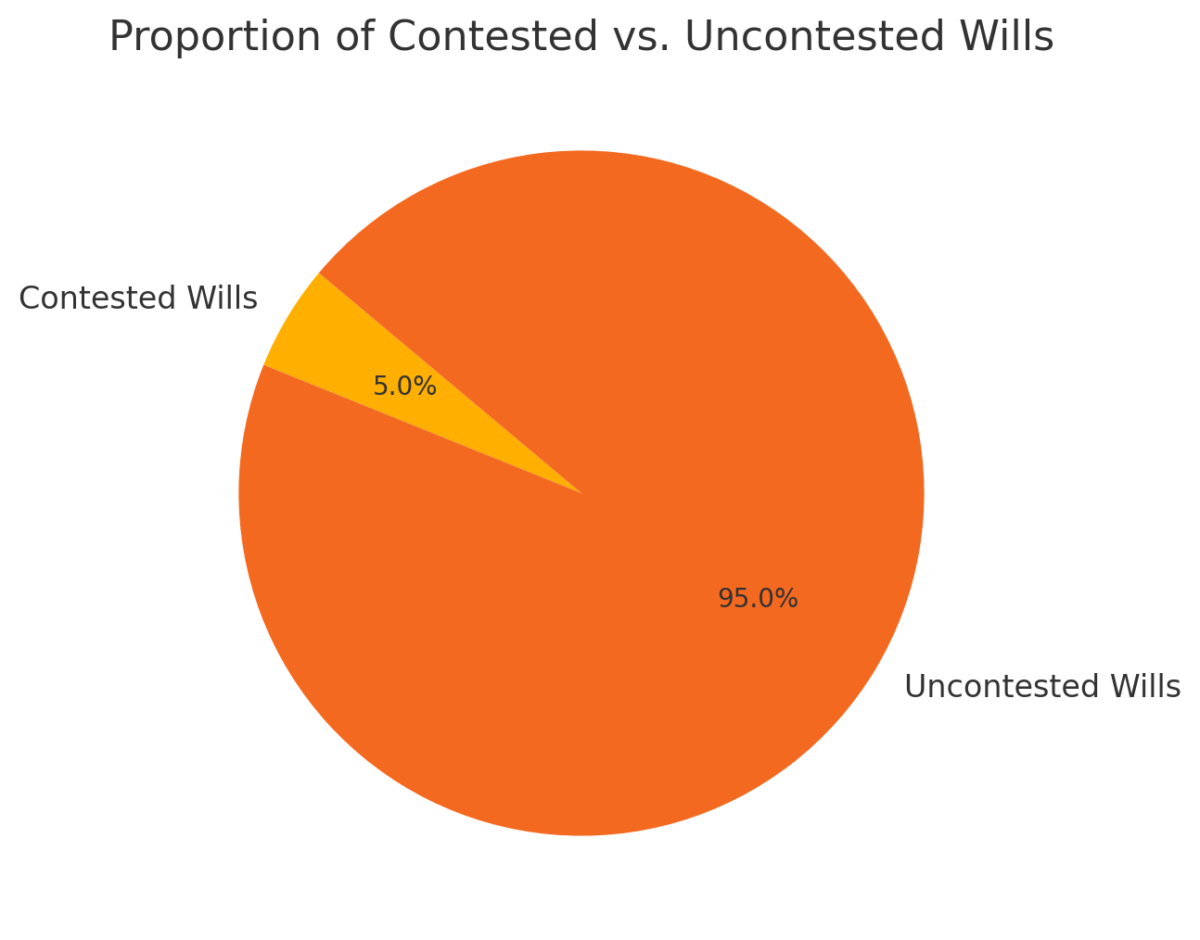

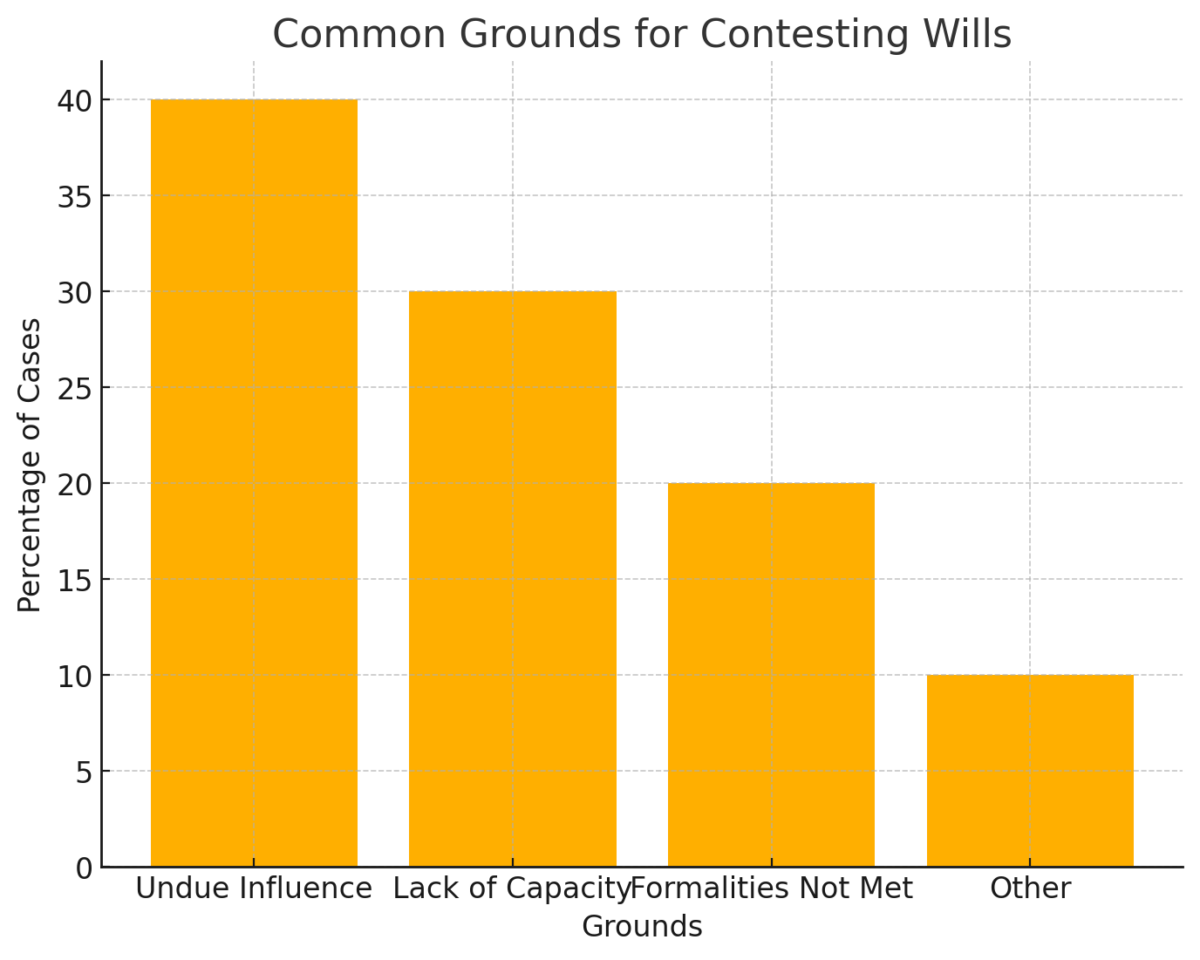

Contested probate cases, in which individuals dispute the validity of a will or the distribution of an estate, are relatively uncommon. Research indicates that approximately 5 percent of all wills are contested. Although that number may seem low, given that millions of wills are probated annually, this percentage translates to a substantial number of contested cases each year. The most common grounds for contesting a will include allegations of undue influence, lack of testamentary capacity, and failure to adhere to required formalities.

If you would like to learn more about probate and contesting wills, call a Bergen County estate planning lawyer to schedule a confidential consultation.

Bergen County Estate Planning FAQs

What is estate planning?

Estate planning is a branch of law that governs how you can make sure your estate, like your home, investments, money etc. ends up where and the way you want it when you pass.

Can I designate who will take care of my minor children in an estate plan?

Yes. In fact, this is one of the best ways you can choose to will care for your minor children.

What if I want to leave a portion of my estate to a charity or other organization?

An estate plan is precisely where you can name the organizations you want to support after your death.

What happens if I die without an estate plan?

If you die without an estate plan you are said to have died intestate. It means the state of New Jersey will govern how your estate is distributed. For example, they might award custody of your minor children to their other parents even though you were divorced from them and would have wanted someone else to care for them.

What is a virtual estate plan

It’s a plan for your digital assets after you pass. For example, you’ve probably got a membership in a variety of online accounts from social media through bank accounts and maybe even cryptocurrency. Such a plan can save your estate money and help protect your reputation and your assets.

What are the main alternatives to a will?

Joint tenancy with the right of survivorship is one of the main alternatives for avoiding probate. If you hold property in a joint tenancy with the right of survivorship the property will pass to the surviving owner when one owner dies. The property will not pass through probate before going to the survivor.

However, tax costs may cause individuals to refrain from placing property in a joint tenancy with the right of survivorship. Future taxes may be higher for the individual receiving the property, and families need to discuss the tax consequences of their estate planning decisions with an experienced estate planning lawyer.

Also, the individual who you believe will survive may die before you, and the property will still pass through probate administration upon your death. You do not want to disinherit anyone so it is important to consider the possible outcomes of every decision you make regarding your estate plan.

You may also name a beneficiary on every asset by using a beneficiary designation. “Pay on death” accounts and documents are also useful tools individuals can use to avoid probate administration. A revocable trust is still a better option if you do not want to use a valid will to avoid probate administration.

What are the differences between a will and a revocable trust?

Revocable trusts are often used as will substitutes. A revocable trust avoids probate, and this can save you time and money if you own multiple properties in different jurisdictions. One trust can manage your assets and avoid probate administration in each state where the properties are located.

No conservatorship proceedings will occur if you place your property in a revocable trust. If you fund the revocable trust then a conservatorship will be unnecessary because the trustee can manage assets for the decedent.

Revocable trusts require that you transfer legal ownership of all assets to the trust while you are still alive. When you obtain more assets during your life you need to place these assets in the name of the revocable trust.

What is probate?

Probate administration may be formal or informal. Probate refers to the formal process by which a court identifies the assets owned by a decedent. The decedent’s creditors and beneficiaries must also be recognized so assets can be administered according to the rules of probate in effect in the State of New Jersey.

Your estate must pass through probate administration whether you have a last will and testament or not. Probate is a formal court process and many delays, waiting periods, and unexpected scheduling issues can make probate administration last nine to twelve months. An estate planning lawyer in Bergen County, New Jersey can help you learn how to avoid both formal and informal probate administration.

How do I know if I have all the documents I need for my estate plan?

While every estate is different, most should have a will or trust to detail what happens to assets such as property, money, stocks, jewelry or other assets upon your passing. Many people also desire a medical or health care power of attorney should they become incapacitated. Sometimes clients wish to create advance directives for medical decisions so their wishes can be honored and the burden of making those decisions is not left to loved ones. While these are some common documents used to protect one’s estate, each person’s desires are unique, so it is usually best to consult a Bergen County estate planning lawyer to see what documents you need.

Kaplan Law Practice, LLC, Bergen County Estate Planning Lawyer

350 W Passaic St, Rochelle Park, NJ 07662

Contact Our Bergen County Estate Planning Lawyer Today

If you don’t yet have a virtual estate plan in place, as part of your existing estate plan or because you don’t yet have an estate plan, please connect with the Law Offices of Joshua Kaplan today. Scheduling a consultation with a knowledgeable Bergen County, NJ estate planning lawyer will help to ensure that your wishes are clearly articulated, enforceable, and ultimately honored.